Table of Contents

Amazon has launched a new AI chatbot that aims to make online shopping easier and more fun. The chatbot, named Rufus, is a personal shopping assistant that can answer product questions, provide recommendations, and explain features and benefits in a friendly and conversational way.

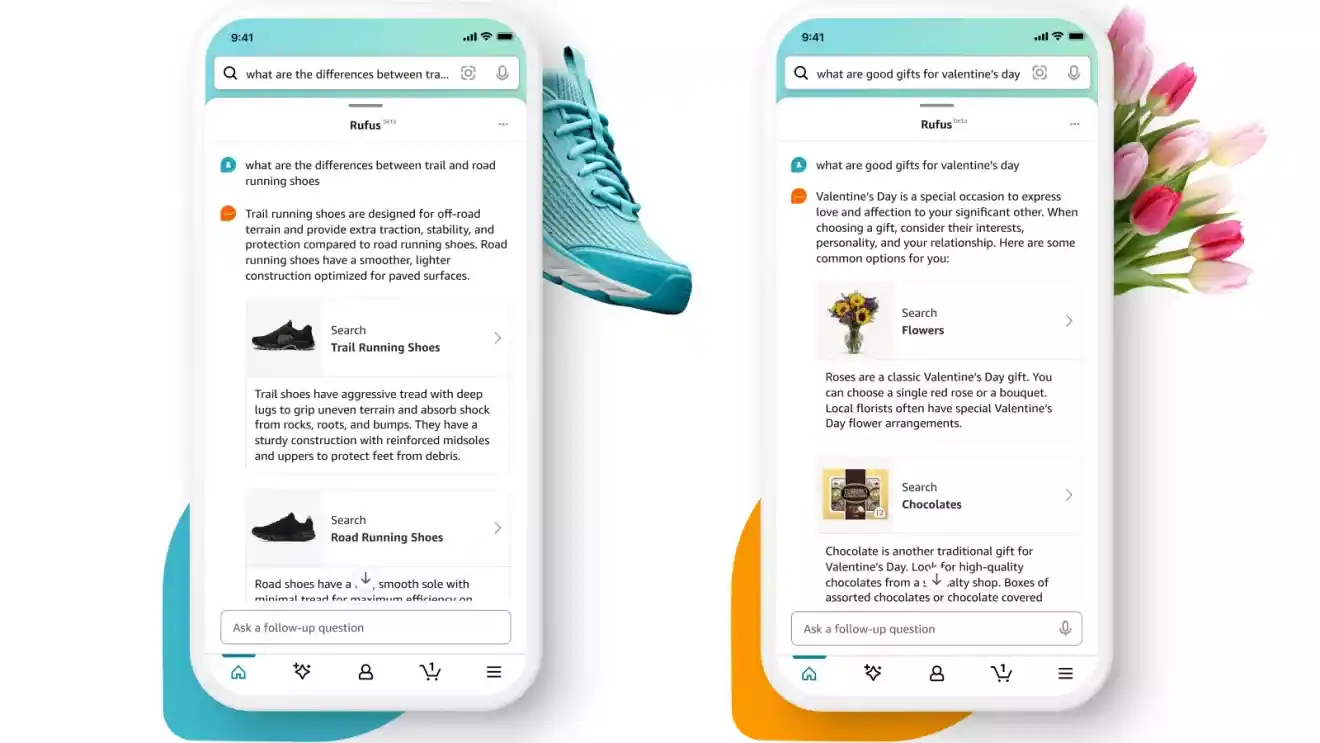

Rufus is integrated into the search bar of the Amazon mobile app, where customers can type or answer their queries. Rufus can handle a variety of requests, such as comparing different models of coffee makers, suggesting gifts for different occasions, or answering follow-up questions about the quality and durability of running shoes.

How Amazon Rufus Works

Amazon Rufus is powered by artificial intelligence and natural language processing, which enable it to understand customer needs and preferences and to generate relevant and helpful responses. Rufus is also trained in Amazon’s vast product catalog, customer reviews, community Q&A, and information from across the web, which gives him access to a wealth of knowledge and insights.

Amazon Rufus is designed to be more than just a search tool. It is meant to be a shopping companion that can guide customers through their purchase journey, from discovery to decision. Rufus can also engage customers in a dialogue, asking clarifying questions, offering suggestions, and providing feedback.

For example, a customer who is looking for a golf ball can ask Rufus for the best option for better spin control. Amazon Rufus will then explain what factors affect the spin of a golf ball, such as the cover material, the dimple pattern, and the compression. Rufus will also recommend some products that meet the customer’s criteria, and provide links to the product pages for more details.

Why Amazon Rufus Matters

Rufus is Amazon’s latest attempt to catch up with the competition in the field of AI chatbots. Other tech giants, such as Microsoft and Google, have already released their chatbots and AI tools for their search engines, focusing on shopping-related use cases. Start-ups, such as Perplexity, have also tried to innovate the search experience with AI.

Amazon has been lagging in this area, despite being the leader in e-commerce. The company has been perceived as being behind on the wave of AI tools that emerged more than a year ago when the start-up OpenAI released its ChatGPT chatbot, which can generate realistic and coherent texts on any topic.

Amazon has been working to improve its AI capabilities, both for its customers and its business. In the fall, Amazon released a corporate chatbot, called Q, for customers of its cloud computing division, AWS. The company also said it was working to make its Alexa voice assistant more conversational and personalized.

Rufus is Amazon’s first consumer chatbot, and it could have a significant impact on the online shopping landscape. Rufus could potentially change the way customers search for and discover products on Amazon, and give the company more control over the shopping experience.

Rufus could also help Amazon boost its advertising revenue, one of its most profitable segments. Advertising grew 27 percent, to $14.7 billion, in sales in the fourth quarter of 2020. Amazon Rufus could attract more advertisers who want to reach customers who are in the early stages of their shopping journey when they are still exploring and researching their options. Amazon Rufus could also take away ad sales from Google and social media sites, where companies try to influence customer decisions.

Rufus is currently available to a small subset of customers, and will be rolled out to more customers in the coming weeks. Amazon declined to provide more details about how many people will be part of the initial release. Rufus is named after a dog that was one of the first to roam Amazon’s offices in the company’s early days. Amazon permits its staff members to bring their dogs to the workplace.

Amazon’s Strong Fourth-Quarter Earnings

Rufus’s launch coincided with Amazon’s announcement of its strong fourth-quarter earnings, which beat analysts’ expectations and the company’s forecast. In the previous year, sales for the quarter reached $170 billion, showing a 17 percent increase. The company had $10.6 billion in profits.

The fourth-quarter results were fueled in part by the holiday season, which saw a surge in online shopping due to the pandemic. The services that Amazon provides to third-party sellers on its marketplace, such as fulfillment and shipping, and the advertisements it offers to brands and sellers, experienced particularly strong quarters.

Investors have been keeping a close eye on Amazon’s most profitable segments, cloud computing and advertising. AWS grew 13 percent, to $24.2 billion, just meeting investor expectations.

Over the past year, Amazon has made several changes to its operations, such as cutting tens of thousands of jobs, ending speculative projects, halting some expansion plans, and reorganizing its logistics to be faster and more efficient. The company had its highest-ever quarterly operating income and projected confidence that profitability would continue.