Table of Contents

Unlocking the Potential: Generative AI in Banking

Technology’s Integral Role in Banking

Banks have a strong affinity for technology. They are deeply involved in the data industry and any technological advancements that enhance their ability to manage data efficiently and effectively are eagerly embraced. Traditional AI was quickly embraced by banks, and it appears that they will also be swift in adopting generative AI.

Banks are embracing the implementation of generative AI, which offers the potential for increased profits, enhanced decision-making capabilities, and improved risk management. However, this adoption also entails new challenges, worries, and expenses that banks must effectively address.

It is anticipated that the testing of AI solutions will experience an acceleration in the coming two to five years, with the potential for incremental benefits to be realized.

The implementation of AI by banks has the potential to provide them with distinct advantages and improved efficiencies, resulting in a competitive edge. Consequently, this could potentially impact our assessment of creditworthiness, particularly in terms of business operations, financial outcomes, and risk mitigation.

In a recent analysis titled “AI in Banking: AI Will Be An Incremental Game Changer,” Miriam Fernández, associate director of financial institutions at S&P Global Ratings, thoroughly examined the adoption, application, and challenges of generative AI within the banking sector.

Insights from Miriam Fernández’s Analysis

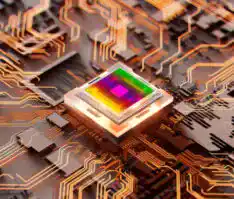

Fernández and other analysts have stated that banks have been utilizing conventional machine learning, a technology that recognizes patterns, for many years to assist in data classification, enhance employee skills, streamline operations, detect fraud, and forecast future events.

The interconnected sectors of banking, financial services, and insurance contribute approximately 18% to the overall machine-learning market. Typically, financial services firms depend on major third-party machine learning providers like Amazon Web Services, Microsoft Azure, and Google ML.

Marginal Changes and Transformative Capabilities

Banks will experience only marginal changes with the implementation of AI, as its advanced capabilities primarily excel in pattern recognition. Consequently, functions that heavily rely on patterns will witness the most significant transformation. Nevertheless, the true revolution lies in generative AI’s capacity to process vast quantities of data, encompassing text, images, videos, and code, and generate content based on this information.

Generative AI will have a significant impact in various domains, including personalization, algorithmic trading, and risk management, among others.

The projected spending on AI for this year is estimated to exceed $166 billion, with banking accounting for nearly 13% of the overall expenditure. In the short run, financial institutions are anticipated to concentrate on enhancing their current procedures by utilizing generative AI to achieve greater efficiencies.

Dominance in Domains: Personalization, Trading, Risk Management

Generative AI has faced skepticism from various quarters. Critics argue that algorithms trained on current practices might inadvertently reinforce and perpetuate existing biases related to gender, race, and ethnicity. Additionally, there are concerns about regulatory measures, as several governments have shown a readiness to tightly control the implementation of generative AI.

Workforce implications also come into play, with many banks emphasizing that their interest in generative AI is to enhance the capabilities of their existing employees. However, some individuals fear that the adoption of efficient technologies could result in job losses. Lastly, it is important to acknowledge the significant environmental impact of generative AI.

Studies suggest that training a generative AI model consumes more energy annually than 100 average American households.

Strategic Concerns in IT Infrastructure Enhancement

The banking sector’s primary concern may lie in the ability to swiftly enhance its IT infrastructure to incorporate generative AI, disregarding other worries. In the banking industry, delaying the adoption of technology can often have more detrimental consequences than embracing it prematurely.